Contents

Introduction

The Union Budget for the year 2017 was announced by Finance Minister Arun Jaitley on Wednesday, 1st February 2017. The Budget proposals are set under ten distinct themes to foster this agenda. These themes are:

- (i) Farmers: for whom we have committed to double the income in 5 years;

- (ii) Rural Population: providing employment and basic infrastructure;

- (iii) Youth: energising them through education, skills and jobs;

- (iv) Poor and the Underprivileged: strengthening the systems of social security, health care and affordable housing;

- (v) Infrastructure: for efficiency, productivity and quality of life;

- (vi) Financial Sector: growth and stability through stronger institutions;

- (vii) Digital Economy: for speed, accountability and transparency;

- (viii) Public Service: effective governance and efficient service delivery through people’s participation;

- (ix) Prudent Fiscal Management: to ensure optimal deployment of resources and preserve fiscal stability; and

- (x) Tax Administration: honouring the honest tax payers.

Farmers

The target for agricultural credit in 2017-18 has been fixed at a record level of 10 lakh crores. The farmers will also benefit from 60 days’ interest waiver announced by the Prime Minister in respect of their loans from the cooperative credit structure.

Core Banking District Cooperative Banks: The central Government will support NABARD for computerization and integration of all 63,000 functional Primary Agriculture Credit Societies (PACS) with the Core Banking System of District Central Cooperative Banks.

Fasal Bima Yojana: The government has announced that the coverage of the scheme will be increased from 30% of cropped area in 2016-17 to 40% in 2017-18 and 50% in 2018-19. For 2017-18, Rs 9,000 crores are allocated. The sum insured under this Yojana has more than doubled from Rs 69,000 crores in Kharif 2015 to Rs 1,41,625 crores in Kharif 2016.

Soil testing labs: Government has decided to set-up new mini labs in Krishi Vigyan Kendras (KVKs) and ensure 100% coverage of all 648 KVKs in the country.

Long Term Irrigation Fund: PM announced Rs 20000 crore to the Long-Term Irrigation Fund set up at NABARD making the total Fund size to Rs 40000 crores.

Micro-irrigation Fund: will be set up at NABARD to achieve the goal of ‘per drop more crop’. The Fund will have an initial fund allocation of Rs 5000 crore.

Agricultural Marketing and e-NAM: The coverage of National Agricultural Market (e-NAM) will be expanded to 585 APMCs. Assistance up to a ceiling of Rs 75 lakhs will be provided to every e-NAM market for the establishment of cleaning, grading and packaging facilities. States would be urged to denotify perishables from APMC so that farmers will get more opportunity to sell their produce and get better prices.

Diary Development: A Dairy Processing and Infrastructure Development Fund will be set up in NABARD with an amount of Rs 8,000 crores over 3 years.

Rural Population

Poverty eradication: A Mission Antyodaya will be undertaken to bring one crore households out of poverty and to make 50,000 gram panchayats poverty free by 2019, the 150th birth anniversary of Gandhiji.

Employment -MGNREGA: Allocation for the scheme will be increased from Rs 38,500 crores under in 2016-17 to Rs 48,000 crores in 2017-18. The scheme has realised its set target of 5 lakh farm ponds and 10 lakh compost pits announced in the last Budget from MGNREGA. It is expected that about 10 lakh farm ponds would be completed by March 2017.

Rural Roads: The Pradhan Mantri Gram Sadak Yojana (PMGSY): The pace of construction of PMGSY roads has accelerated to reach 133 km roads per day in 2016- 17. Connecting roads are now constructed in habitations with more than 100 persons in left wing extremism affected Blocks. The budget allocates a sum of Rs 19,000 crores in 2017-18 for this scheme. Together with the contribution of States, an amount of Rs 27,000 crores will be spent on PMGSY in 2017-18.

Rural Housing: The Budget propose to complete 1 crore houses by 2019 for the houseless and those living in kutcha houses. The budget for this purpose increases allocation to Pradhan Mantri Awaas Yojana – Gramin from Rs 15,000 crores in BE 2016-17 to Rs 23,000 crores in 2017-18.

Village Electrification: the country is on the way to achieve 100 percent village electrification by 2018. An allocation of Rs 4,814 crores is proposed under the Deendayal Upadhyaya Gram Jyoti Yojana in 2017-18.

Rural skill development: For Deendayal Antyodaya Yojana- National Rural Livelihood Mission for the promotion of skill development and livelihood opportunities for people in rural areas an amount of Rs 4,500 in 2017-18.

Safe drinking water: to over 28000 arsenic and fluoride affected habitations in the next four years. This will be made a sub mission of the National Rural Drinking Water Programme (NRDWP).

Skill and training for rural population: For imparting new skills to the people in the rural areas, mason training will be provided to 5 lakh persons by 2022, with an immediate target of training at least 20,000 persons by 2017-18.

The total allocation for the rural, agriculture and allied sectors in 2017-18 is Rs 1,87,223 crores, which is 24% higher than the previous year.

Youth

SWAYAM platform will be empowered with at least 350 online courses. It will enable students to virtually attend the courses taught by the best faculty; access high-quality reading resources; participate in discussion forums; take tests and earn academic grades. Access to SWAYAM would be widened by linkage with DTH channels, dedicated to education.

Major renovations will be implemented in the case of UGC. Greater administrative and academic autonomy will be provided to higher educational institutions. Colleges will be identified based on accreditation and ranking and given autonomous status.

A National Testing Agency: will be established as an autonomous and self-sustained premier testing organisation to conduct all entrance examinations for higher education institutions. This would free CBSE, AICTE and other premier institutions from these administrative responsibilities so that they can focus more on academics. The focus will be on 3,479 educationally backwards blocks. Colleges will be identified based on accreditation.

PMKK: Pradhan Mantri Kaushal Kendras (PMKK) will be extended to more than 600 districts across the country from the present 60 districts. For the promotion of skill development, 100 India International Skills Centres will be established across the country. These Centres would offer advanced training and also courses in foreign languages. This will help those of our youth who seek job opportunities outside the country.

SANKALP: Skill Acquisition and Knowledge Awareness for Livelihood Promotion programme (SANKALP) will be constituted at a cost of Rs 4,000 crores. SANKALP will provide market relevant training to 3.5 crore youth.

STRIVE: The next phase of Skill Strengthening for Industrial Value Enhancement (STRIVE) will also be launched in 2017-18 at a cost of Rs 2,200 crores. STRIVE will focus on improving the quality and market relevance of vocational training provided in ITIs and strengthen the apprenticeship programmes through industry cluster approach. Special employment creation scheme for leather and footwear industries: A scheme will be implemented for the leather and footwear industries in line with the one that is launched for the textile sector. Tourism: Five Special Tourism Zones, anchored on SPVs, will be set up in partnership with the States. Incredible India 2.0 Campaign will be launched across the world.

Courses on foreign languages will be introduced. The government will also take to create 5000 PG seats per annum.

The Poor and the Underprivileged

Mahila Shakti Kendra (Women Development): Mahila Shakti Kendra will be set up at village level with an allocation of Rs 500 crores in 14 lakh ICDS Anganwadi Centres. This will provide one-stop convergent support services for empowering rural women with opportunities for skill development, employment, digital literacy, health and nutrition. A nationwide scheme for financial assistance for the pregnant woman with a transfer of Rs 6000 is already launched by the PM.

Gender budgeting: For the welfare of Women and Children under various schemes across all Ministries, the budget has an allocation from Rs 1,56,528 crores in BE 2016-17 of Rs 1,84,632 crores in 2017-18 compared to Rs 156528 crore in the last budget.

Affordable housing: National Housing Bank will refinance individual housing loans of about Rs 20,000 crore in 2017-18.

Fight against chronic diseases: Government has prepared an action plan to eliminate Kala-Azar and Filariasis by 2017, Leprosy by 2018 and Measles by 2020 and tuberculosis by 2025 is also targeted.

IMR and MMR reduction targets: An action plan has been prepared to reduce IMR from 39 in 2014 to 28 by 2019 and MMR from 167 in 2011-13 to 100 by 2018- 2020. Approximately 1.5 lakh Health Sub Centres will be transformed into Health and Wellness Centres.

Medical education to support community health: an additional 5,000 Post Graduate seats per annum will be created to ensure adequate availability of specialist doctors. In addition, steps will be taken to roll out DNB courses in big District Hospitals; strengthen PG teaching in select ESI and Municipal Corporation Hospitals, and encourage reputed Private Hospitals to start DNB courses. For a structural transformation of the Regulatory framework of Medical Education and Practice in India, necessary steps will be taken by the government. Two new All India Institutes of Medical Sciences will be set up in the States of Jharkhand and Gujarat.

Aadhaar-based smart cards will be issued to senior citizens to monitor health. Aadhar based Smart Cards for Senior Citizens: Aadhar based Smart Cards containing the health details will be introduced for senior citizens. A pilot project will be initiated in 15 districts during 2017-18. The LIC will implement a scheme for senior citizens to provide assured pension, with a guaranteed return of 8% per annum for 10 years.

Regulating (prices) of medical devices: New rules for regulating medical devices will also be formulated to ensure their availability. This will be modelled on the basis of the existing Drugs and Cosmetics Rules. These rules will be internationally harmonised so that they can attract investment and reduce the cost of such devices.

Reform in labour laws: Efficient labour laws should be set to protect the labour rights, healthy industry labour relations and at the same time to ensure higher productivity. Legislative reforms will be undertaken to simplify, rationalise and amalgamate the existing labour laws into 4 Codes on (i) wages; (ii) industrial relations; (iii) social security and welfare; and (iv) safety and working conditions.

The Model Shops and Establishment Bill 2016: has been circulated to all States for consideration and adoption. The Bill will open up additional avenues for employment of women. The amendment made to the Payment of Wages Act is another initiative of the Government to benefit labour and ease of doing business.

The welfare of SCs, STs and minorities: The allocation for the welfare of Scheduled Castes has increased from Rs 38,833 crores in 2016-17 to Rs 52,393 crores in 2017-18, ( an increase of 35%). The allocation for Scheduled Tribes has been increased to Rs 31,920 crores and for Minority Affairs to Rs 4,195 crores. The Government will introduce outcome-based monitoring of expenditure in these sectors by the NITI Aayog.

Infrastructure

Allocation for Railways: Railway budget is incorporated into the general budget for the first time this year. For 2017-18, the total capital and development expenditure of Railways has been pegged at Rs 1,31,000 crores. This includes Rs 55,000 crores provided by the Government. Passenger Safety: A Rashtriya Rail Sanraksha Kosh will be created with a corpus of Rs 1 lakh crores over a period of 5 years for enhancing passenger safety. Besides seed capital from the Government, the Railways will arrange the balance resources from their own revenues and other sources. Government will lay down clear cut guidelines and timeline for implementing various safety works to be funded from this Kosh. Unmanned level crossings on Broad Gauge lines will be eliminated by 2020. Expert international assistance will be harnessed to improve safety preparedness and maintenance practices. In the next 3 years, the throughput is proposed to be enhanced by 10%. This will be done through modernisation and upgradation of identified corridors. Railway lines of 3,500 kms will be commissioned in 2017- 18, as against 2,800 kms in 2016-17. Steps will be taken to launch dedicated trains for tourism and pilgrimage.

Station Development: A beginning has been made with regard to station redevelopment. At least 25 stations are expected to be awarded during 2017-18 for station redevelopment. 500 stations will be made differently abled friendly by providing lifts and escalators.

Swachh Rail: SMS based Clean My Coach Service has been started. It is now proposed to introduce ‘Coach Mitra’ facility, a single window interface, to register all coach related complaints and requirements. By 2019, all coaches of Indian Railways will be fitted with bio toilets. Pilot plants for environment-friendly disposal of solid waste and conversion of biodegradable waste to energy are being set up at New Delhi and Jaipur railway stations. Five more such solid waste management plants are now being taken up.

Metro Rail Policy and Act: A new Metro Rail Policy will be announced with focus on innovative models of implementation and financing, as well as standardisation and indigenisation of hardware and software. A new Metro Rail Act will be enacted by rationalising the existing laws. This will facilitate greater private participation and investment in construction and operation.

Road sector: Total allocation for the railways goes up from Rs 57,976 crores in BE 2016-17 to Rs 64,900 crores in 2017-18. Around 2,000 kms of coastal connectivity roads have been identified for construction and development. This will facilitate better connectivity with ports and remote villages. The total length of roads, including those under PMGSY, built from 2014-15 till the current year is about 1,40,000 km. Multi-modal logistic parks: A specific programme for

Multi-modal logistic parks: A specific programme for the development of multi-modal logistics parks, together with multi-modal transport facilities, will be implemented.

Airport modernization: Select airports in Tier 2 cities will be taken up for operation and maintenance in the PPP mode. Airport Authority of India Act will be amended to enable effective monetization of land assets. The resources, so raised, will be utilised for airport upgradation. For transportation sector, as a whole, including rail, roads, shipping, the budget provides Rs 2,41,387 crores in 2017-18.

Private sector participation in mobile broadband through spectrum auction and digital connectivity: Telecom sector is an important component of our infrastructure eco system. The recent spectrum auctions have removed spectrum scarcity in the country.

Bharat Net: Under the BharatNet Project, OFC has been laid in 1,55,000 kms. The allocation for BharatNet Project to will be stepped up to 10,000 crores in 2017-18. By the end of 2017-18, high speed broadband connectivity on optical fibre will be available in more than 1,50,000 gram panchayats, with wifi hot spots and access to digital services at low tariffs. A DigiGaon initiative will be launched to provide telemedicine, education and skills through digital technology.

Strategic crude reserve: For strengthening our Energy sector, Government decided to set up Strategic Crude Oil Reserves. In the first phase, 3 such Reserves facilities have been set up. Now in the second phase, it is proposed to set up caverns at 2 more locations, namely, Chandikhole in Odisha and Bikaner in Rajasthan. This will take our strategic reserve capacity to 15.33 MMT( the three existing facilities are at Mangalore, Visakhapatnam and Padur (nr Udupi)..

Solar energy: In solar energy, the second phase of Solar Park development for additional 20,000 MW capacity.

Electronic manufacturing: the allocation for incentive schemes like M-SIPS (Modified Special Incentive Package) and EDF (Electronics Development Fund) to an all-time high of Rs 745 crores in 2017-18. M-SIPS has emerged as the leading incentive scheme for the promotion of electronic goods sector.

Export Infrastructure: A new and restructured Central scheme, namely, Trade Infrastructure for Export Scheme (TIES) will be launched in 2017-18. The total allocation for infrastructure development in 2017-18 stands at Rs 3,96,135 crores.

Financial Sector

Abolition of FIPB: More than 90 % of FDI is now put through automatic route. Similarly, -there is e-filing and online processing of FDI applications. In this context, the FIPB as an approval agency is meaningless and is to be abolished in 2017-18.

Bringing commodity market benefits to farmers: Commodity market reforms are needed to benefit farmers. An expert committee will be constituted to study and promote creation of an operational and legal framework to integrate spot market and derivatives market for commodities trading. e-NAM would be an integral part of such framework.

Tackling Illicit deposits: The draft bill to curtail the menace of illicit deposit schemes has been placed in the public domain and will be introduced shortly after its finalisation.

Financial Sector Resolution Regime: The bill relating to resolution of financial firms will be introduced in the current Budget Session of Parliament. This will contribute to stability and resilience of our financial system.

Dispute resolution mechanism for PPP contracts and public utility contracts: institutional arrangements for resolution of disputes in infrastructure related construction contracts, PPP and public utility contract. The required mechanism would be instituted as part of the Arbitration and Conciliation Act 1996 with an amendment.

Disinvestment: The shares of Railway PSEs like IRCTC, IRFC and IRCON will be listed in stock exchanges.

Consolidation and Strengthening CPSEs: There is opportunities to strengthen the CPSEs through consolidation, mergers and acquisitions. For this, the CPSEs can be integrated across the value chain of an industry. Such a consolidation will give them capacity to bear higher risks, avail economies of scale, take higher investment decisions and create more value for the stakeholders. Possibilities of such restructuring are visible in the oil and gas sector. The budget proposes to create an integrated public sector ‘oil major’ which will be able to match the performance of international and domestic private sector oil and gas companies.

Disinvestment through ETF: ETF, comprising shares often CPSEs, has received an overwhelming response in the recent Further Fund Offering (FFO). ETFs thus emerged as a vehicle for disinvestment of shares. Hence a new ETF with diversified CPSE stocks and other Government holdings will be launched in 2017-18.

Capitalization of PSBs: Budget allocates Rs 10,000 crores for the recapitalisation of PSBs in 2017-18. Additional allocation will be provided, as may be required. A legal framework to facilitate resolution, through the enactment of the Insolvency and Bankruptcy Code and the amendments to the SARFAESI and Debt Recovery Tribunal Acts has already been made.

Securitization: Listing and trading of Security Receipts issued by a securitization company or a reconstruction company under the SARFAESI Act will be permitted in SEBI registered stock exchanges. This will enhance capital flows into the securitization industry and will particularly be helpful to deal with bank NPAs.

Pradhan Mantri Mudra Yojana: The PMMY has contributed significantly to funding the unfunded and the underfunded. Last year, the target of Rs 1.22 lakh crores was exceeded and 2017-18, lending target would be doubled to Rs 2.44 lakh crores. Priority will be given to Dalits, Tribals, Backward Classes, Minorities and Women.

Entrepreneurship support for weaker sections: The Stand-Up India scheme was launched by our Government in April 2016 to support Dalit, Tribal and Women entrepreneurs to set up greenfield enterprises and become job creators. Over 16,000 new enterprises have come up through this scheme in activities, as diverse as food processing, garments, diagnostic centres, etc.

Digital Economy

India is now on the cusp of a massive digital revolution. Promotion of a digital economy is an integral part of Government’s strategy to clean the system and weed out corruption and black money. It has a transformative impact in terms of greater formalisation of the economy and mainstreaming of financial savings into the banking system. This, in turn, is expected to energise private investment in the country through lower cost of credit. JAM and financial inclusion have facilitated development.

Extension of BHIM App: Already there is evidence of increased digital transactions. The BHIM app will unleash the power of mobile phones for digital payments and financial inclusion.

Aadhar Pay: Aadhar Pay, a merchant version of Aadhar Enabled Payment System, will be launched shortly. This will be specifically beneficial for those who do not have debit cards, mobile wallets and mobile phones. A Mission will be set up with a target of 2,500 crore digital transactions for 2017-18 through UPI, USSD, Aadhar Pay, IMPS and debit cards. Banks have targeted to introduce additional 10 lakh new PoS terminals by March 2017. They will be encouraged to introduce 20 lakh Aadhar based PoS by September 2017.

Digital Transaction promotion for SMEs: Increased digital transactions will enable small and micro enterprises to access formal credit. The government will encourage SIDBI to refinance credit institutions which provide unsecured loans, at reasonable interest rates, to borrowers based on their transaction history.

Payment infrastructure enhancement in institutions and markets: The digital payment infrastructure and grievance handling mechanisms shall be strengthened. The focus would be on rural and semi urban areas through Post Offices, Fair Price Shops and Banking Correspondents. Steps would be taken to promote and possibly mandate petrol pumps, fertilizer depots, municipalities, Block offices, road transport offices, universities, colleges, hospitals and other institutions to have facilities for digital payments, including BHIM App. A proposal to mandate all Government receipts through digital means, beyond a prescribed limit, is under consideration. The government will consider and work with various stakeholders for the early implementation of the interim recommendations of the Committee of Chief Ministers on digital transactions.

PSS amendment and Payments Regulatory Board: The Committee on Digital Payments (Ratan P Watal) constituted by Department of Economic Affairs has recommended structural reforms in the payment ecosystem, including amendments to the Payment and Settlement Systems Act, 2007.

The Government will undertake a comprehensive review of this Act and bring about appropriate amendments. To begin with, it is proposed to create a Payments Regulatory Board in the Reserve Bank of India by replacing the existing Board for Regulation and Supervision of Payment and Settlement Systems. Necessary amendments are proposed to this effect in the Finance Bill 2017

Public Service

The Direct Benefit Transfer platform is extended to deliver 84 Government schemes. LPG and kerosene are about to be provided through DBT

Prudent Fiscal Management

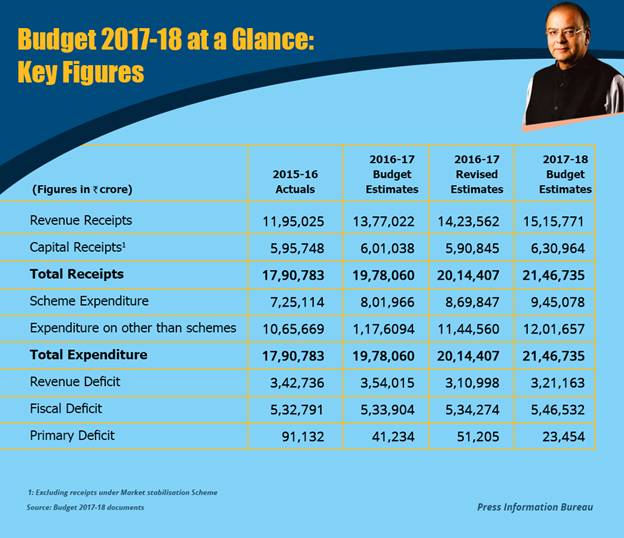

The total expenditure in Budget for 2017-18 has been placed at Rs 21.47 lakh crores. With the abolition of Plan-NonPlan classification of expenditure, the focus is now on Revenue and Capital expenditure. Allocation for Capital expenditure has been increased by 25.4% over the previous year. FRBM Committee and follow up: The FRBM Review Committee has given its report recently. The Committee has done an elaborate exercise and has recommended that a sustainable debt path must be the principal macroeconomic anchor of our fiscal policy. The Committee has favoured Debt to GDP of 60% for the General Government by 2023, consisting of 40% for Central INDIANECONOMY.NET 10 Government and 20% for State Governments. Within this framework, the Committee has derived and recommended 3% fiscal deficit for the next three years. The Committee has also provided for ‘Escape Clauses’, for deviations upto 0.5% of GDP, from the stipulated fiscal deficit target. Among the triggers for taking recourse to these Escape Clauses, the Committee has included “far-reaching structural reforms in the economy with unanticipated fiscal implications” as one of the factors. The Committee has suggested a fiscal roadmap for fiscal consolidation in the next three years with an FD target of 3% of GDP. For the proposed budget, the FD is kept at 3.2%, targeting for its reduction to 3% in the next year.

Personal Income Tax

Up to Rs 250000: Nil

Rs 250001 to Rs 5 lakh: 5 per cent

Rs 500001 to Rs 10 lakh: 20 per cent

Above Rs 10 lakh: 30 per cent

Renewable energy:

Tremendous duty concession to the renewable energy sector- BCD of Fuel Cell based power generating systems reduced to 5% countervailing duty reduced to 6%. Basic Customs Duty for Solar tempered glass for the manufacture of solar cells eliminated. Customs duty – both basic and Countervailing of several solar components were reduced or eliminated. Excise duty on renewable energy machinery was reduced to 6%.

Cash transaction of more than Rs 3 lakh is banned: Government appointed Special Investigation Team (SIT) for black money has suggested that no transaction above Rs 3 lakh should be permitted in cash. The Government has decided to accept this proposal. Suitable amendment to the Income-tax Act is proposed in the Finance Bill for enforcing this decision.

GST: Efforts to implement the GST is in progress. Centre, through the Central Board of Excise & Customs, shall continue to strive to achieve the goal of implementation of GST as per schedule.

Tax Administration:

Tax revenue growth: A remarkable feature of tax revenue growth for 2017-18 is that tax-GDP ratio is going up, helped by the robust growth rate of Personal Income Tax revenue and Union Excise Duties. For 2017- 18, the tax-GDP ratio of the centre is estimated at 11.3% of GDP with a tax revenue growth rate of 12.2%. Direct taxes are expected to contribute to 51.3% of the total tax revenue, getting marginally higher than indirect taxes. Among direct taxes, the Corporate Income Tax growth rate is 9,1% whereas Personal Income Tax is estimated to grow at a phenomenal rate of 24.9%. Indirect tax revenue is expected to grow at 25% weighted by a high growth rate of Union Excise Duties.

A remarkable feature of tax revenue growth for 2017-18 is that tax-GDP ratio is going up, helped by robust growth rate of Personal Income Tax revenue and Union Excise Duties. For 2017- 18, the tax-GDP ratio of the centre is estimated at 11.3% of GDP with a tax revenue growth rate of 12.2%. Direct taxes are expected to contribute to 51.3% of the total tax revenue, getting marginally higher than indirect taxes. Among direct taxes, the Corporate Income Tax growth rate is 9,1% whereas Personal Income Tax is estimated to grow at a phenomenal rate of 24.9%. Indirect tax revenue is expected to grow at 25% weighted by a high growth rate of Union Excise Duties.

Major expenditure items of the Government:

- Interest payment continues to be the largest expenditure item.Defence is the second largest expenditure item and subsidy is projected to come down to 1.4% of GDP as the third largest expenditure item. Declining subsidy expenditure is a pleasant development. at the same time, the rising food subsidy is a matter of concern from the fiscal angle.