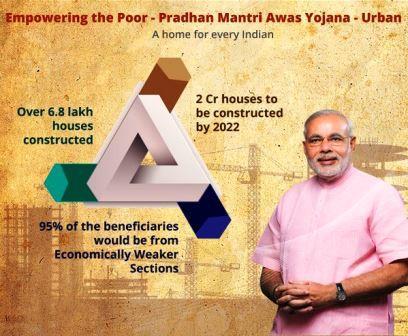

It envisions Housing for All by 2022 and it subsumed Rajiv Awas Yojana and Rajiv Rinn Yojana.

It seeks to address the housing requirement of urban poor including slum dwellers through following programme

- Slum rehabilitation with participation of private developers.

- Promotion of Affordable Housing for weaker section through Credit Linked Subsidy

- Affordable Housing in Partnership with Public & Private sectors

- Subsidy for beneficiary-led individual house construction

It covers all 4041 statutory towns as per Census 2011 with focus on 500 Class I cities in three phases.

Centre and State will be funding in the ratio of 75:25 and in case of North Eastern and special category States in the ratio of 90:10

Beneficiaries – Urban poor who does not own a pucca house, Economically Weaker Section (EWS) and Lower Income Groups (LIG – eligible only for credit linked subsidy scheme).

States/UTs have flexibility to redefine the annual income criteria with the approval of Ministry.

Under the mission, a beneficiary can avail of benefit of one component only.

HUDCO and NHB have been identified as Central Nodal Agencies (CNAs) to channelize this subsidy to the lending institutions.

Credit Linked Subsidy – It is an interest subsidy available to a loan amounts upto Rs 6 lakhs at the rate of 6.5 % for tenure of 20 years or during tenure of loan whichever is lower.

The houses will be allocated preferably in the name of Women in the family.

Rajiv Awas Yojana – It envisages a “Slum Free India” with inclusive and equitable cities in which every citizen has access to basic civic infrastructure and social amenities and decent shelter.

Rajiv Rinn Yojana – Rajiv Rinn Yojana (RRY) is an instrument to address the housing needs of the EWS/LIG segments in urban areas, through enhanced credit flow.